Invoice Factoring

Use invoice factoring services to access operating capital when needed.

In the dynamic world of business, not every company enjoys an overflow of equity and readily available working capital. It’s a common scenario for growing businesses to face the challenge where cash flow doesn’t sync with expenses. You may have sales recorded in your books, reliable clients, and promising opportunities on the horizon. However, essential costs like employee wages, lease payments, and inventory purchases can’t be deferred. That’s where Invoice Factoring steps in to bridge the gap between your outstanding invoices and immediate financial needs.

What is Invoice Factoring?

Invoice Factoring addresses the common conundrum faced by many businesses: having significant working capital tied up in accounts receivable while still needing to cover essential expenses.

Your company may boast a strong sales record, loyal clientele, and a robust ledger of accounts receivable. Yet, the reality remains that expenses such as payroll, lease payments, and ongoing purchases cannot wait for invoice payments to materialize. This shortfall in working capital not only hampers your current operations but also poses a risk to potential future sales.

Enter “factoring” – a reliable solution also known as “invoice factoring” or “accounts receivable factoring.” It’s a secure mechanism designed to convert unpaid invoices into immediate working capital. By leveraging your outstanding invoices, Invoice Factoring ensures that your business has the necessary funds to navigate cash flow challenges without hindering growth or jeopardizing future opportunities.

At Capitally, we understand the frustration of thriving businesses facing financial constraints due to working capital shortages.

That’s why our Invoice Factoring solution is tailored to provide swift access to financing, solely based on the strength of your accounts receivable.

Regardless of your equity position or financial ratios, our financing empowers you to access 75% or more of the value of your accounts receivable. Whether you’re looking to fuel expansion initiatives or meet ongoing expenses, Invoice Factoring unleashes the potential of your accounts receivable, allowing you to focus on what truly matters – growing your business.

Say goodbye to the stringent requirements of traditional bank loans. When the bank says “no,” Invoice Factoring says “yes” to your immediate financial needs. Let Capitally handle the management and collection of financed invoices while providing transparent reporting to keep you informed every step of the way.

With Invoice Factoring, your working capital isn’t just an asset – it’s the catalyst for your business’s success.

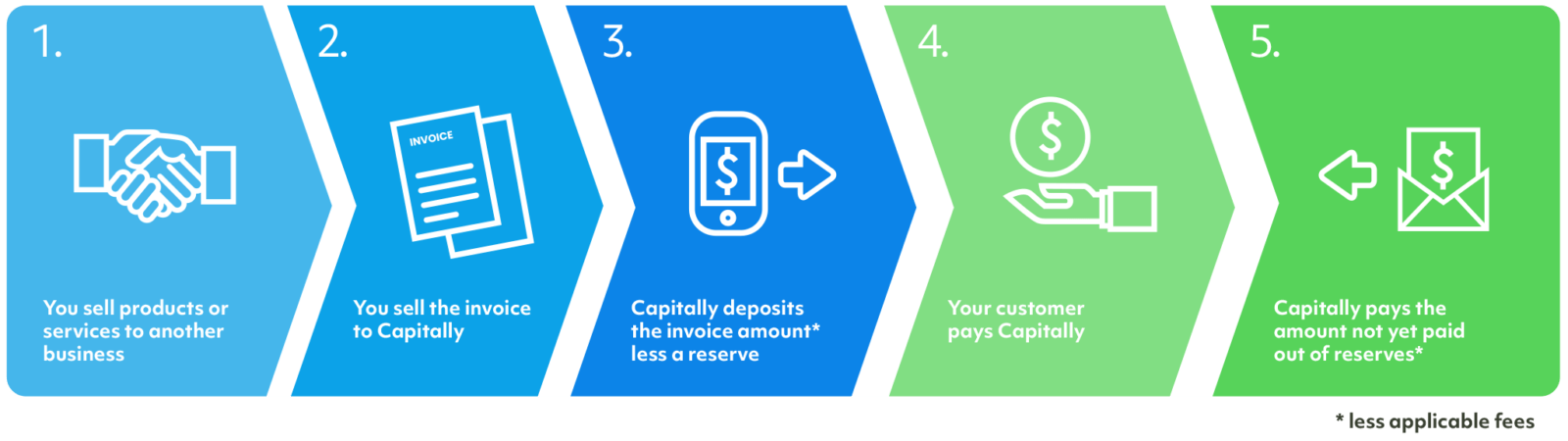

How it Works in Your Business

Accounts receivable factoring from Capitally delivers a range of business benefits

Our best-in-class service is delivered through a widespread local distribution network. Capitally has a large network of points of presence among factoring providers in North America. This means you interact with decision makers in your area who possess a deep understanding of your market, your business, and your unique requirements.

In the fast-paced realm of business, timing is everything. Whether you need to meet payroll obligations or seize a time-sensitive opportunity, delays are simply not an option. With our streamlined processes, we can often establish a factoring facility for you in under a week, ensuring that you can capitalise on opportunities without delay.

Enjoy complete transparency with comprehensive reporting and round-the-clock online support. We take accountability seriously, providing you with access to invoice images, supporting documents, collection notes, and payment details. With this level of visibility, you’re always in the know about the status of your receivables.

Bid farewell to lengthy contracts and hidden fees. Our receivables factoring solution doesn’t bind you with one- or two-year contracts or surprise you with hefty termination fees. We believe in straightforward terms and transparent pricing, ensuring a hassle-free experience for our clients.

Benefit from affordable credit insurance as part of our offering. By passing on credit insurance to our clients, we enable them to mitigate credit risks at highly reasonable rates. It’s an intelligent strategy to minimize both business and personal guarantees related to credit.

Gain better control over a critical asset class. Managing accounts receivable and collections issues can be a drain on resources for growing companies. With our services, we take on the responsibility of managing, collecting, and reporting on your accounts receivable, allowing you to focus on driving your business forward.

Your financing is solely based on your customers’ creditworthiness. Unlike traditional banks that scrutinize financial ratios, equity, and other factors, receivables factoring hinges on the quality of your customers. If you have reliable customers, you have good credit, making financing accessible and straightforward.

Success Stories

Invoice factoring helped these businesses unlock more working capital without taking on debt.

Empowering entrepreneurs to do more, be more, dream more through alternative business financing solutions.

Invoice factoring qualifications?

In today’s dynamic market, securing funding swiftly can be crucial, especially when traditional loan avenues hit roadblocks. That’s where invoice factoring steps in, offering a lifeline to keep your operations running smoothly – often in as little as one day.

To qualify for Capitally’s invoice factoring services, your business should meet the following criteria:

Your business must:

✓ Operate within the B2B sector, regardless of size or stage of growth

✓ Serve other businesses rather than direct consumers

✓ Encounter challenges meeting the stringent criteria for traditional bank loans

✓ Currently have a less than-ideal credit rating, although your customers maintain strong creditworthiness

✓ Boast a clientele with a history of consistently honouring invoice payments

Your sales must:

✓ Be invoiced with credit terms extended to clients

✓ Showcase a robust pipeline of future business opportunities

✓ Include accounts receivables from creditworthy customers, ensuring timely payment on due dates

Your invoices must:

✓ Bear standard invoice terms such as net 30, net 60, or net 90 from the date of issuance

✓ Be free from any liens or encumbrances

✓ Adhere to specified credit terms and limits

Don’t let funding challenges hold your business back. Explore how invoice factoring can provide the financial flexibility your company needs to thrive.

We’re always ready to help

Capitally is a full-service working capital and trade finance company that grows with you. Get personalized strategic guidance and up to $20 Million in fast funding.